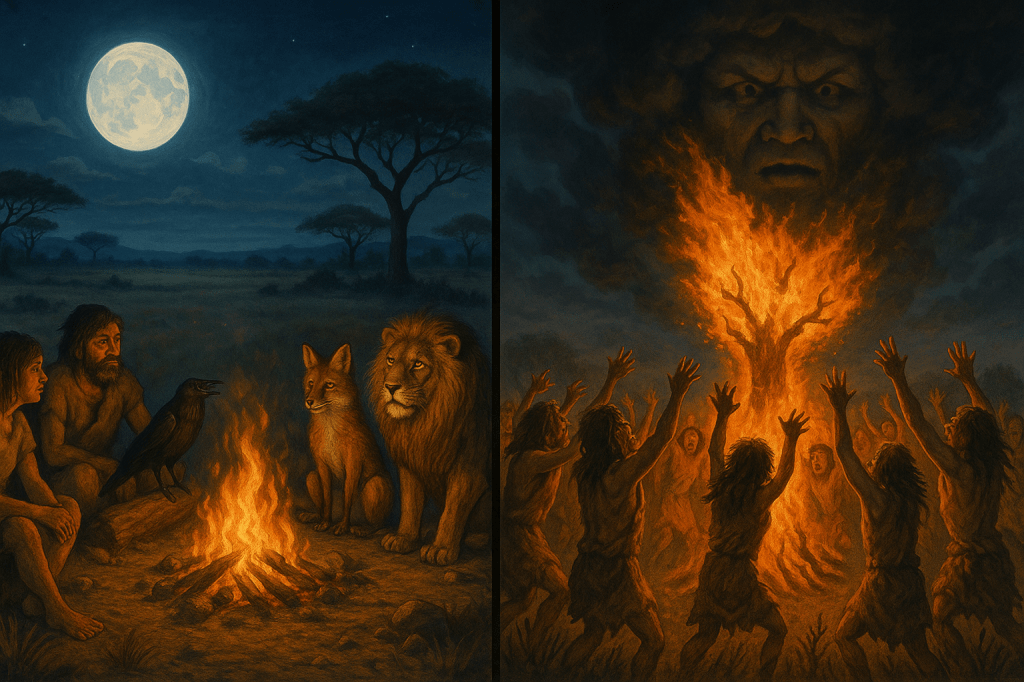

Without immediate community development initiatives, South Africa will descend into modern-day tribal warfare—one fought in concrete townships instead of open savannah.

While South Africa’s GDP’s steady climb paints a picture of progress, reality for the majority of South Africans is different. At the “low” end, 55% subsist on or below the poverty line – they are the “cannot” class. A feature of this “we don’t know how” group is that its members are pretty much stuck here. On the one hand, there are little to no government community development initiatives, and on the other, the hundreds of millions of Rand handed out to cronies to help their communities have disappeared.

The next 25–30% make up the “Sure, I can… if you hold my hand” SA middle level. It’s the “floater” class. The environment, situation, and advancement vehicle (unskilled, some skill, semi-skill) dictate the degree to which help is needed. This is also the reason for the 5% variance—sometimes members of this group are floundering along with the 55%, and at others, the top end of this group might be joyfully struggling at the bottom end of the top 15% group. Whatever, they float between not making ends meet, struggling to make ends meet, and just managing when circumstances favour them. All live under the stress of rising debt. Whereas under tribal conditions of just a generation back they had traditional means to cover short-term emergency needs, in modern economic terms they are a bad risk.

Rising debt becomes super significant among SA’s top echelon of black staff—the 15%. Over half have “maxed out” their credit cards and home mortgage accounts. While many achieved their positions through genuine talent and many more could succeed on merit alone, most owe their success to government policy and “winds blowing their way” through connections. And winds change.

Nothing here is new or hidden knowledge, yet such is the cover-up of this uncompetitiveness naked state that parliamentarians are currently attacking banks for their “biased” lending policies. No one dares ask the fundamental question: “Why is this wholesale borrowing happening at all?”

No one dares to think through the consequences to households of lenders being forced to call in their loans. Worse, the rocksolids of parliament have not the slightest idea of what will happen to the nation when lenders call in their already too much lent loans on the whole 15%.

Leave a comment